So you finally got your first car and are getting insurance. Yup, we know how this can be a daunting task, especially with all the insurance terms and policy options. The price and the deductible amount should not be the only things that guide you when you choose a car insurance company. If you need to have your car repaired, knowing that you can choose your repairer instead of being sent to a shop selected by your insurance company can be a big help. Knowing the difference between having that “choice of repairer” option and having a “preferred repairer” is important when deciding on what insurance is best for you.

Take note: there isn’t a universal answer to what’s the better option. It will still depend on your individual needs and preferences. This beginner’s guide will help you determine what you should consider when choosing your car insurance policy.

When your insurer has a ‘preferred repairer’, it means they already have a pre-existing agreement with a repair company. But suppose you have specific needs for your car. In that case, you already have a relationship with a repair shop, or you want to keep a watchful eye on what’s being done to your vehicle, you may want to choose your repair shop.

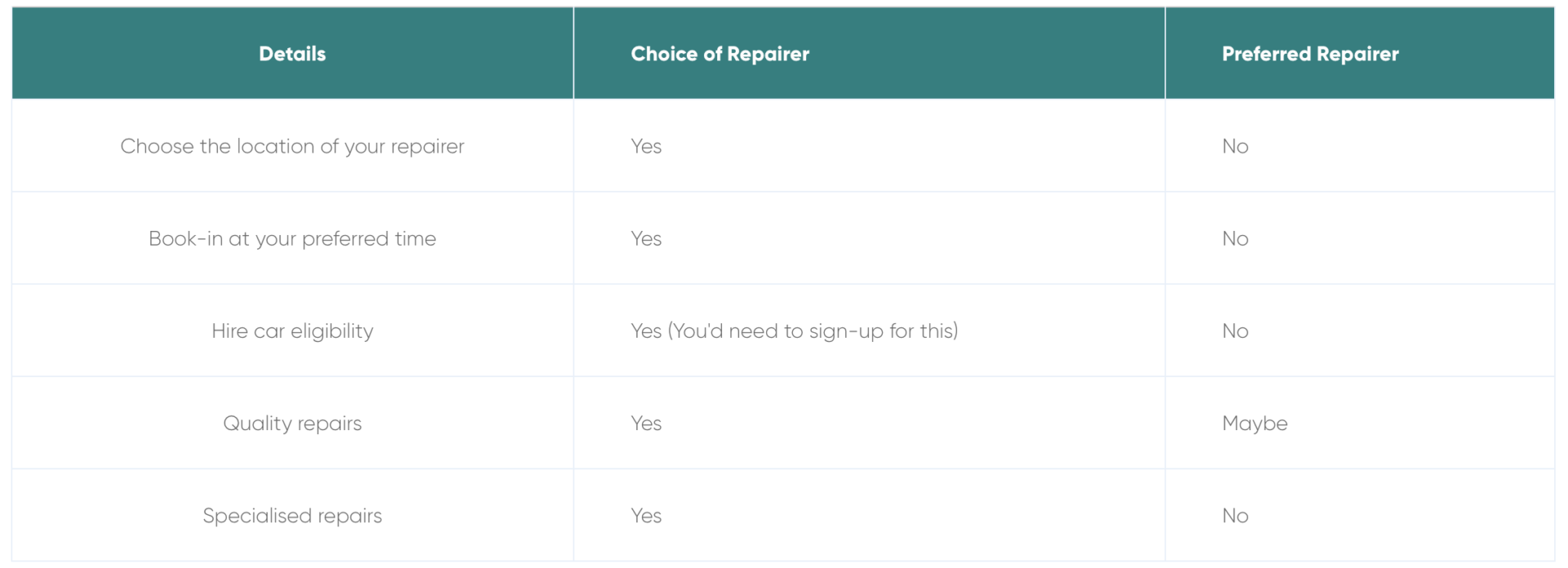

In the car insurance industry, “choice of repairer” means that you can choose who will fix your car. Having a “preferred repairer”, on the other hand, limits you on where you can bring your vehicle for any repairs needed. But there’s more to that, as there are advantages and disadvantages to both options.

Having a choice of repairer lets you go to Flow Autobody, one of Brisbane’s most trusted smash repair shops! Only trust the experts and check our wide range of repair services here.

In a free market where customers decide on their own, the business with the best value proposition, customer experience, satisfaction, and service always wins. With the preferred repairer network scheme, the biggest problem we see is this: do the repairers work for you or do they work for the insurance company? If the latter is the case, do they have your best interests in mind? Then will you be treated like a number and not get the best customer service? Not at all! But at least you have the power to choose the quality of your experience and the fate of your car when you choose a repair shop.

If you’re like most people, you won’t get into many car accidents, and you won’t be an expert at smash repair. Sticking with a ‘preferred repairer’ can also save you from a different sort of hassle, as you are letting your insurance company handle everything for you.

The Australian Competition and Consumer Commission says that insurers’ preferred repairer schemes may help repairers get paid and recover costs more quickly and help insurers manage payments and recover costs with repairers. But still, like ‘choice of repairer’, this can also come with both positives and negatives.

There isn’t always a single best way to save money when getting repairs done. If you have a lot of faith in your insurance company, or if you don’t have the luxury of time to put effort into smash repairs, you can go this way.

In the car insurance industry, there are rules and limitations about who can fix your car. Insurers often limit the repair shop you can use. Choose a repair shop on your own and then tell your insurance company about it. If the insurance company doesn’t like your repair shop choice, it could cost you money.

Take a look at the small print in your policy and check with your insurance company before choosing a repair shop.

You get to choose a quote, but not the person who will fix it. This means that you can get a quote from a repairer of your choice. Still, the insurance company might not use your repairer if the quote doesn’t meet the insurer’s standards for safety and cost. Your insurer can refuse your repair quote if it thinks it’s too high, but you don’t have to choose a repair shop.

There is a lifetime guarantee for repairs, but the guarantee can be different from one insurance company to the next:

Having the ability to choose when and where you get your auto body repairs done may not be such a deal-breaker for everyone. However, this isn’t the only factor that could make or break your insurance repair experience. There are other important factors to consider like getting a courtesy car, opting for a repair specialist, or being guaranteed quality repairs.

Most, if not all, ‘preferred repairers’ don’t include a courtesy car for when you leave your vehicle at their shop. In some cases, you might end up paying for a car rental out of your own pockets if public transport isn’t an option.

Preferred repairer work may not always cut it either, especially if your car requires a specialist. If you have a choice of repairer, car insurance companies will still cover your repairs even if you bring your car to a specialty repair shop. Insurance repair work isn’t the same for every auto repair shop.

With a choice of repairer policy, you can have more peace of mind since you ultimately get to call the shots and go with a repairer your trust. This, of course, means that you’d definitely need to do the research on your own before choosing where to go.

There are pros and cons to both options, and the best one for you isn’t always the best for everyone else. Initially, you’d be ecstatic over the cheaper price that an insurance policy with a ‘preferred repairer’ comes with. You’re thinking, you might not need the extra that premium plans offer… Not until you get into an accident and you realise you’ve made a mistake.

Watch the short video below to see two scenarios showing one with a choice of repairer and one with a preferred repairer:

In a nutshell, Jane is a busy mom who’s always on-the-go, trying to balance her daily schedule. Because of this, she doesn’t have the luxury of time and wants to have control over when and where the repairs will be done. Fred, on the other hand, is a laid-back guy who would rather have convenience over control. For him, simpler is better so let his car insurance company handle all the repairs is ideal. It takes less effort, even though it means having fewer options, too.

You see, if you’re like Jane who wants to have more control over the repairs with the extra budget to allot for it, you’re better off having your ‘choice of repairer’. Car insurance companies will cover the expenses of your accident repairs wherever you choose to have it done, whenever you need it done.

However, if you relate more to Fred who prefers not having to fuss-over repair matters, having a ‘preferred repairer’ may be a better option for you. What’s great about it is it’s generally cheaper upfront and more straightforward as you’ll be informed of which repairer your insurance will partner with. However, if the shop is outside your local area or out of your way, then unfortunately you’d have to adjust. You’d also need to patiently wait when your car is due for repairs as it will depend on the repairer’s availability.

As shown in the video, both Jane and Fred could have had a pleasant experience even if they opted for different insurance policies. The key thing to remember is that you should be clear of your priorities and preferences in order to make a truly informed decision on your insurance and avoid unfortunate surprises in the aftermath of an accident.

Now you’ve got the two types of insurance questions sorted, let’s look at these insurances at work during an accident. So let’s say you got into a prang, you’re not at fault and you need your car repaired ASAP. While going through your insurance, you go over the T&Cs and find out you don’t have a choice of repairer. What do you do then? The short answer is, you can’t do anything about it at this point. You could’ve avoided this pickle at the very beginning by being more informed about your insurance options.

Many policyholders often overlook this essential detail until they lodge their claims to their provider. And because you can’t suddenly change the terms of your policy, you should carefully read up first before deciding which policy is best for you.

If you’re in a crash with another vehicle, the first thing you need to know is if you’re not-at-fault because this will help determine who should be liable for the repair costs. Regardless of whether you have ‘choice of repairer’ or ‘preferred repairer’, the party at-fault should be liable to pay.

With your choice of repairer, car insurance companies will let you pick the best repair shop, such as Flow Autobody! When you work with us, we will do our best to turn the painful and inconvenient experience of getting your repairs done into a positive and seamless one. You can get a FREE estimate on our website and check out our Learning Hub to learn more about your repairs. Get in touch if you have any repair or insurance questions you’d like to ask us.

Insurers can agree with certain repair shops (called preferred or partner repairers), where the insurer will do more work in exchange for lower prices on repairs. It makes sense, but not all the time. Your car may not get the amount of time, attention, or parts it needs to get its damaged parts fixed. This can lead to shortcuts in the repair and poor quality work as a result.

Insurers can agree with certain repair shops (called preferred or partner repairers), where the insurer will do more work in exchange for lower prices on repairs. It makes sense, but not all the time. Your car may not get the amount of time, attention, or parts it needs to get its damaged parts fixed. This can lead to shortcuts in the repair and poor quality work as a result.

Whenever you make insurance claims, you usually need to pay basic excess, plus other expenses that may be imposed. However, you may not need to shell out any money at all if the company deems you not-at-fault and if they can obtain the at-fault driver’s information. Their full name, address, and vehicle registration number are needed so that they can charge the insurance cost to them instead.

A not-at-fault insurance claim, in most cases, won’t affect your insurance policy and premiums. If the at-fault driver or their insurance provider covers the damages, then your insurance shouldn’t be affected at all. The at-fault driver will be liable for the costs and you won’t even need to pay any basic excess, so long as the insurer determines you didn’t cause the accident in any way. However, if you fail to gather the necessary information to properly contact the other driver, you might end up using your own insurance and covering your insurance excess.

Since there’s usually a fixed cost you need to pay as basic excess when you make claims, you need to get an estimate first. Basically, the higher your premiums are, the lower the cost of your basic excess. As mentioned, there may also be additional expenses on top of the basic excess. Even if you’re not-at-fault, you still need to assess the costs and the situation. You must have the information of the at-fault driver otherwise, you will still shoulder the basic excess even if you’re not liable for the accident. Weigh the actual cost of the repairs versus the additional expenses you will be shelling out if the at-fault driver doesn’t cover it.

Hot Reads